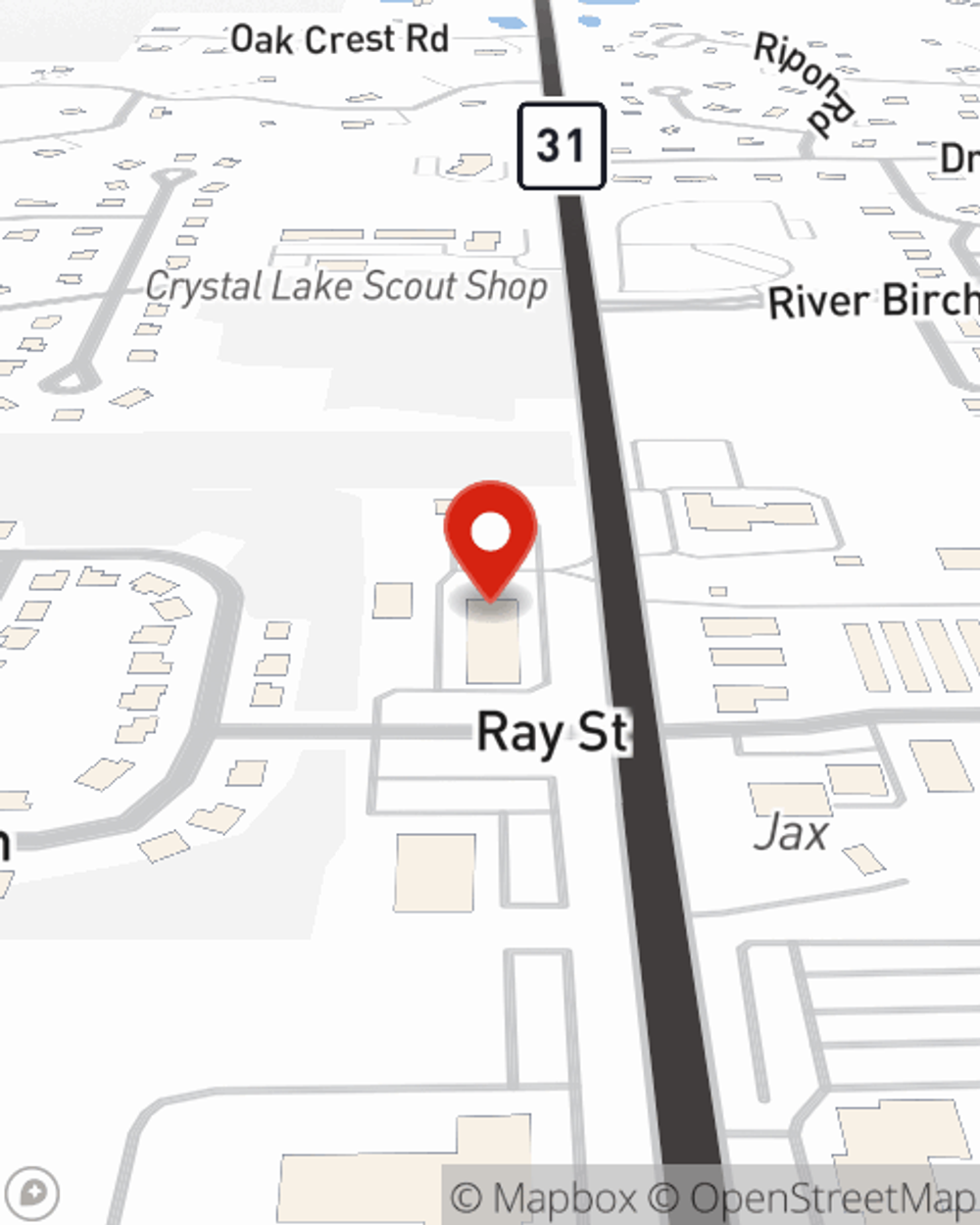

Renters Insurance in and around Crystal Lake

Your renters insurance search is over, Crystal Lake

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

The place you call home is the cornerstone for everything you treasure. It’s where you build a life with the ones you love. Home is truly where your heart is. That’s why, even if you live in a rented condo or space, you should have renters insurance—even if your landlord doesn’t require it. It's coverage for the things you do own, like your silverware and golf clubs... even your security blanket. You'll get that with renters insurance from State Farm. Agent Jason Styzinski can roll out the welcome mat with the dedication and wisdom to help you insure your precious valuables. Skilled care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Your renters insurance search is over, Crystal Lake

Your belongings say p-lease and thank you to renters insurance

Protect Your Home Sweet Rental Home

Renters often don’t realize that their landlord’s insurance only covers the structure. Just because you are renting a property or space, you still own plenty of property and personal items—such as a desk, a piece of family jewelry, coffee maker, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why secure your belongings with renters insurance from Jason Styzinski? You need an agent who wants to help you choose the right policy and evaluate your risks. With efficiency and wisdom, Jason Styzinski is waiting to help you keep your things safe.

Contact Jason Styzinski's office to learn more about how you can benefit from State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call Jason at (815) 444-0400 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Jason Styzinski

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.